PayPal is among the top online payment systems in the world. It lets its users make purchases, pay, or transfer money online with other credit services, PayPal has its own called PayPal Credit services PayPal.

Here’s how they usually phrase their offer:

“Buy now and pay later with PayPal Credit”. How refreshing to know that your dream purchase might be well within reach.

Paying over time is not so daunting when no interest applies There are many factors that can lead to an individual’s success, such as hard work, passion, determination or luck and in the case of PayPal, a revolutionary idea.

But how does one qualify for such a product? As with most credit products, there is an approval process for PayPal Credit UK.

As they say IF YOUR PAYPAL ACCOUNT IS IN GOOD STANDING AND YOU ALREADY HAVE PROOF OF IDENTITY THEN APPLY NOW!!!!! But how does it really work and how would you apply for it? Find out more in this comprehensive guide on PayPal Credit UK—let’s get right into it!

Table of Contents

What is PayPal Credit

PayPal Credit is a convenient line of credit that allows you to shop online using your PayPal account. It provides instant access to funds, letting you make purchases even when you’re short on cash.

This service acts like a digital credit card. You can spread the cost of your purchases over time or pay them off in full later. It’s especially useful for larger expenses where immediate payment might not be feasible.

With PayPal Credit, transactions are simple and secure. When checking out with PayPal at various retailers, you’ll see an option to use your credit balance seamlessly. This means no need for additional cards or lengthy applications during checkout.

Moreover, it offers promotional financing options from participating merchants, allowing you to buy now and pay later without incurring interest if paid within the promotional period. It’s an efficient way to manage finances while enjoying the convenience of online shopping.

Read About: Get a Mortgage for Auction Property

How Does a PayPal Credit Work

PayPal Credit acts like a virtual credit card linked to your PayPal account. When you make an eligible purchase, you can choose to pay over time rather than all at once.

Once approved for PayPal Credit, you’ll receive a credit line that allows flexibility in payments. This means you can shop online or in-store with merchants that accept PayPal.

Your purchases will appear on your monthly statement. You have the option to pay off the balance each month or spread it out over time. Just remember, interest may apply if not paid within certain promotional periods.

Managing your account is straightforward through the PayPal website or app. You’ll see upcoming payments and outstanding balances clearly laid out, making it easy to stay on top of your finances as you use this service for everyday shopping needs.

What is PayPal Credit interest Rate

PayPal Credit offers a flexible financing option for online shoppers, but understanding its interest rates is crucial. When you use this service, the interest rate can vary based on your creditworthiness and the promotional terms available at the time of application.

Typically, PayPal Credit has an annual percentage rate (APR) that may range from around 19.99% to 23.99%. These rates are competitive compared to some traditional credit cards but can be higher depending on individual circumstances.

It’s important to check for any promotional offers as well. Sometimes, PayPal provides special financing options with reduced or even zero-interest periods if paid within a certain timeframe. Always read the fine print before making significant purchases to avoid surprises down the line.

Being aware of these details helps you make informed choices about using PayPal Credit responsibly while managing potential costs effectively.

Does PayPal Credit affect Credit Score

When you apply for PayPal Credit, it can impact your credit score. This occurs because the application process usually involves a hard inquiry into your credit report.

A hard inquiry may cause a slight dip in your score initially. However, responsible use of PayPal Credit can have positive effects over time. Making on-time payments shows lenders that you’re reliable and helps build a solid payment history.

If you keep your balance low relative to your credit limit, this demonstrates good credit utilization. Low utilization rates are favorable factors in calculating scores.

Conversely, missing payments or carrying high balances can negatively affect your score. It’s crucial to manage repayments wisely if you want to maintain or improve your financial standing while using this service.

Can You Build Your Credit Score using PayPal?

Building your credit score using PayPal is possible, but it comes with specific conditions. When you use PayPal Credit responsibly, such as making on-time payments, it can positively impact your credit history.

PayPal reports to major credit bureaus, meaning that consistent repayment habits may reflect well on your credit report. This visibility can help you establish or improve your overall score over time.

However, relying solely on PayPal Credit for building your credit isn’t sufficient. It’s essential to diversify your types of credit accounts for a healthier mix.

Using this financial tool wisely and staying within limits is crucial. If you’re diligent with payments and mindful of how much you borrow, PayPal could indeed be a stepping stone in enhancing your creditworthiness.

How To use PayPal Credit?

Using PayPal Credit is a straightforward process. First, ensure you have an active PayPal account. If not, sign up for one.

Once your account is ready, navigate to the checkout page of any online merchant that accepts PayPal. When prompted for payment options, choose PayPal and select “Pay with PayPal Credit.”

You can then decide how much credit you want to use for this transaction. This flexibility lets you manage your finances effectively.

After confirming your purchase, keep track of your spending through the PayPal app or website. This helps in staying aware of your available balance and upcoming payments.

Remember that using this service means adhering to repayment terms. Always review these conditions before making a purchase to avoid surprises later on!

Can You Make Monthly Payments with PayPal?

Yes, you can make monthly payments using PayPal. This flexibility allows users to manage their finances more easily.

When you use PayPal Credit, you’re granted a line of credit that lets you pay for purchases over time. You can choose to set up automatic payments or manually pay your balance each month.

Moreover, PayPal provides options like “Pay in 3,” which splits eligible purchases into three equal payments spread over three months. This feature is perfect for budgeting large expenditures without incurring interest.

Keep in mind that staying on top of your payment schedule is crucial. Missed payments could lead to fees and affect your credit score negatively.

Using monthly payment plans with PayPal offers convenience while ensuring you stay within budget.

Can I use PayPal credit To Send Money To a Friend?

Using PayPal Credit to send money directly to a friend isn’t an option. PayPal Credit is designed primarily for purchasing goods and services from merchants that accept it as a payment method.

If you want to share some cash with a friend, you would typically use your linked bank account or debit/credit card instead. This means the funds will come straight from your personal finances rather than relying on credit.

However, once you’ve made purchases through platforms that allow PayPal Credit, you can cover those expenses without impacting your immediate budget.

Just keep in mind that sending money via other methods may incur fees based on the transaction type.

Be sure to check each party’s preferences regarding payment methods too; not everyone may be comfortable receiving payments this way.

Can You Pay Real Debt With PayPal?

PayPal offers a variety of services, but when it comes to paying real debt, the options are limited. While you can use PayPal Credit for purchases or certain bills, paying off credit cards or loans directly with PayPal isn’t typically an option.

Some creditors may accept payments via PayPal if they have set up such arrangements. However, this isn’t universally true and often depends on specific terms from your lender.

For debts like student loans or mortgages, most lenders prefer traditional methods like bank transfers or checks. It’s essential to check with your creditor about acceptable payment methods before attempting to use PayPal for these transactions.

If you’re looking for flexibility in managing existing debts, consider using the funds in your PayPal account to pay bills through linked accounts instead. This way, you maintain control over how and where your money goes while potentially earning rewards through different platforms.

How To increase PayPal Credit Limit

Increasing your PayPal Credit limit can provide you with more flexibility for purchases. To start, ensure you use your current credit responsibly. This means making timely payments and keeping your balance low relative to the limit.

PayPal often reviews accounts automatically based on usage patterns. If you’ve been a consistent user, they may proactively increase your limit without any action needed from you.

If you’re looking to speed up the process, consider reaching out to PayPal directly through their customer service channels. Prepare relevant information about your income and financial stability when requesting an increase.

Regularly checking your credit score is also beneficial. A higher score can improve your chances of receiving a higher credit line approval. Remember, maintaining good habits will not only help with increasing limits but also strengthen overall financial health.

How Can Apply for PayPal Credit UK

Applying for PayPal Credit in the UK is a straightforward process. Start by logging into your PayPal account. If you don’t have one, it’s easy to create.

Once logged in, navigate to the “PayPal Credit” section available on your dashboard. There will be clear prompts guiding you through the application form.

You’ll need some personal details handy, like your address and income information. Ensure everything is accurate to avoid delays.

After submitting your application, you’ll receive a decision quickly—usually within seconds. If approved, you can start using your credit limit immediately for purchases with participating retailers.

Remember that approval isn’t guaranteed; they assess based on creditworthiness and financial history. Always read through the terms before committing to ensure it suits your needs.

Applying for PayPal Credit is relatively straightforward, but there are specific eligibility criteria to consider. Generally, applicants must be at least 18 years old and a resident of the UK.

A good credit history plays a significant role in qualifying for this service. If you have existing debts or negative marks on your report, it might affect your chances.

PayPal also requires that you have an active PayPal account in good standing before applying. This ensures they can assess your financial behavior through previous transactions.

While many people can apply, not everyone will qualify based on their individual financial circumstances. It’s wise to check these requirements before starting the application process to avoid any disappointment later on.

PayPal Credit offers a flexible way to shop online without immediate payment pressure. It allows users to make purchases and pay for them over time, which can be beneficial for managing cash flow.

However, the appeal lies in its convenience. Many retailers accept PayPal Credit, making it easy to finance your favorite items. The application process is straightforward and quick, often providing instant approval.

On the flip side, interest rates can vary significantly based on creditworthiness. If you carry a balance from month to month, those costs can add up quickly.

Moreover, using PayPal Credit responsibly could help build your credit score if you keep payments timely. But like any financial product, it’s crucial to weigh the pros and cons before diving in.

PayPal Credit is widely accepted by various retailers and online platforms across the UK. Many well-known brands partner with PayPal to offer consumers flexible payment options.

You’ll find that popular e-commerce sites, electronics stores, and fashion retailers frequently accept PayPal Credit as a payment method. This includes major players like eBay, Argos, and ASOS.

Additionally, many smaller merchants also embrace this service to provide convenience for their customers. Whether you’re shopping for gadgets or clothing, there’s a good chance you can use your PayPal Credit.

Moreover, some travel companies allow payments via PayPal Credit too. So booking flights or accommodations might be easier than ever when using this option.

Always check at checkout if the retailer accepts it—this ensures hassle-free transactions every time you shop!

| Feature / Factor | Description |

|---|---|

| Loan Amount | Total amount of credit or purchase amount |

| Interest Rate (APR) | Annual Percentage Rate applied to the balance |

| Repayment Period | Duration over which payments are made (e.g., months) |

| Monthly Payment | Calculated payment per month based on loan amount, rate, and period |

| Total Interest Paid | Total interest paid over the repayment period |

| Total Repayment Amount | Sum of principal and interest paid over the loan term |

| Promotional Offers | Special zero-interest or reduced-interest periods |

| Fees | Any additional fees (late fees, origination fees) |

A PayPal Credit calculator is a handy tool for anyone considering financing purchases. It allows users to estimate monthly payments based on the amount they intend to borrow and the interest rate applied.

Using this calculator can help you understand how much you’ll owe each month, making it easier to budget your finances. Simply input the loan amount and select an interest rate, and watch as the tool breaks down potential payment plans.

Many calculators also provide insights into how long it will take to pay off a balance if only minimum payments are made. This feature highlights the impact of making larger payments earlier, potentially saving on interest over time.

Whether you’re planning a big purchase or simply curious about managing your PayPal Credit better, this tool offers valuable information at your fingertips. It’s user-friendly and accessible right from your device without any hassles.

Yes, you can access different PayPal accounts from one computer. This flexibility allows users to manage both personal and business accounts conveniently.

To switch between accounts,

simply log out of the current account and then log in with the other credentials. Keep in mind that this process might require you to enter your password each time.

If you’re using a shared or public computer, it’s crucial to remember to sign out after every session for security reasons. Leaving an account logged in could expose sensitive information.

Additionally, utilizing different browsers or incognito mode can streamline the process. Each browser retains its own login sessions, making it easier to access multiple PayPal accounts without repeated logins.

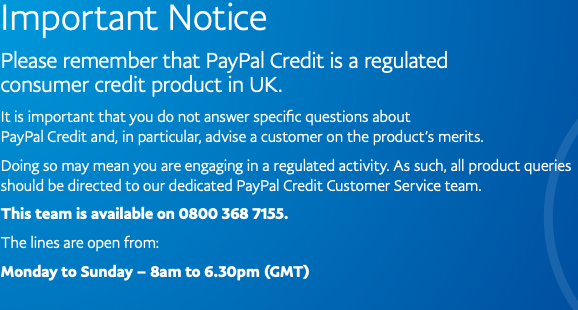

For any inquiries or assistance regarding your PayPal Credit account, it’s essential to know the right contact number.

You can reach out to PayPal customer service for support tailored specifically for PayPal Credit users. The dedicated team is available to help clarify doubts about applications, payments, and other related concerns.

To get in touch with them directly, visit the official PayPal website where you’ll find the most updated contact information. Whether it’s about understanding your credit terms or seeking advice on how to manage your account effectively, their representatives are ready to assist you.

Having this information at hand ensures that you’re never left in the dark when using your PayPal Credit UK services.