Table of Contents

Going to college can be an exciting experience because it has so many benefits. However, many people need first to understand the Student Finance England issue to start their path. You should know how student loans work, whether you are excited about starting college or are already set on your next academic adventure.

It is very important to know what kinds of financial aid are out there for things like tuition and living costs, as well as loans and handouts. Here is a guide that will help you figure out how to pay for your studies in England. To clear things up, let’s break it down!

Available Student Finance includes

It’s important to know about all the different ways that English students can pay for school. Getting different kinds of student loans can make a big difference in your journey through school.

The purpose of this type of loan is to pay for a student’s college costs. With these types of loans, the money is sent straight to the school so that the borrower can focus on their studies instead of their finances.

Along with loans that need to be paid back, students can also get grants and prizes. These types of loans are the most helpful because they are based on talent or need and don’t need to be paid back.

There are also part-time jobs available for students who want to make money while they are in school.

Working and going to school at the same time can help you make money and give you real-world experience in your field.

Who Can Get Student Finance England

There are a few things you need to do to be qualified for Student Finance England. Usually, you need to live in the UK and have settled status. In some cases, you may still be able to get in if you are a student from the EU.

The course of study is also very important. It should be okay with the UK government, and it should usually lead to higher education credentials like degrees or something similar.

Age is another one; most applicants are at least 18 years old. But there is no upper age limit, so kids over 18 are also welcome.

Your amount of support will depend on your financial situation. The review looks at the family’s income, which could include yours and your parents if they are living with you.

Make sure that the school you are going can accept applications. Knowing these needs ahead of time will speed up the application process and improve your chances of getting approved.

Trying to Get Student Loans It’s easy to apply for student loans, but you have to pay close attention to every detail. First, make sure you have all the necessary papers, like a visa and proof that you live in the country.

To sign up, go to the official Student Finance England page. It will guide you through every part of the application and make sure you don’t leave out any information they need.

Please make sure that all of your personal information is correct. If there are any mistakes, the payment may be held up. You should also be ready to show proof of the study and school you went to.

After you click “Submit,” you’ll be able to check the portal to see the progress of your application at any time. Just keep an eye out for any new information or requests for more information.

Remember how important dates are; missing them could affect when you get the money you need for school and living costs. For a stress-free future, stay on top of things and take action during this process!

Read About: Be Careful if You Receive an Email From HMRC

Different Ways To Pay Back and Interest Rates

There are different ways to pay back student loans, and you need to know what they are. Student Finance England has several different payback plans to suit people with different incomes and situations.

Most of the time, you’ll start paying back the loan once your income hits a certain amount. You don’t have to pay back right away if you’re not making enough money.

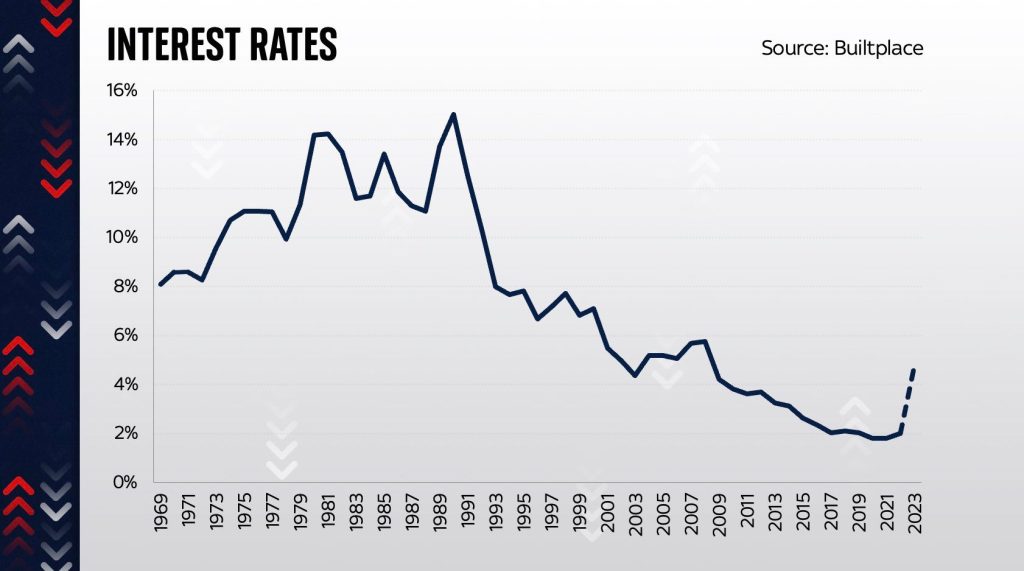

Since interest rates are linked to inflation in some way, the rates that were offered may have been different based on when the loan was taken out. It’s important to keep track because the rates can change the total amount that needs to be paid back.

You might even get extra benefits, like having the loan forgiven after 30 years of payments or more, based on the plan you choose. It’s important to keep an eye on your money to make sure that the bills fit perfectly into your budget.

A lot of students think they owe a lot more on their student loans than they really do. A popular myth is that all student loans are grants, which means they are free. This is not true. Most of the money will come in after you graduate.

Another false belief is that if someone gets financial help, they can’t work while they’re in school. A lot of kids can work part-time jobs and still do well in school in the real world.

Some people believe that student loans only pay for education. Even though that’s a big part of it, it also includes loans for living costs and even extra help for people with disabilities.

The amount of debt you have after college can be scary. Repayment plans make sure that graduates can make fair payments based on their income, not a fixed amount that could be too much for them to afford, no matter what. You need to learn how to pay for school and tell the difference between facts and lies.

Tips for Wise Student Finance Management

It may seem hard to make a budget when you are a student, but it doesn’t have to be. Make a regular budget to start. If you want to know where your money is going, write down what you earn and what you spend.

Try using apps that keep track of how much you spend. In addition to making, it easier to stick to your budget, they also show you where you can make improvements.

Don’t spend money on fun first. Make sure you have a place to live, food to eat, and school while you look for student deals everywhere you can. They add up quickly.

Set aside money in case of an emergency, like when your car breaks down, or you need medical care. You might feel safer if you save a little each month.

Keep in mind that student loans are not free money, so it’s important to stay up to date on how to repay them so that you can handle it when the time comes. Getting into good money habits now will pay off after you graduate.

Student Finance England Contact

Even though the world of student loans can be scary, you don’t have to go through it by yourself. You can get a lot of help from Student Finance England to figure it all out and get answers to any questions you may have about your choices. Starting online is a good idea. Their main website has a lot of information about how to get money for school.

This could include details about what you need to do to be eligible and how to apply. Direct support may also include ways to get in touch with their knowledgeable teams, who can help you with any problems you’re having with your application or payback plan.

How to Call the Helpline:

The number to call to talk to a representative is 0300 100 0607. The lines are open from 8 a.m. to 8 p.m., Monday through Friday, and from 9 a.m. to 4 p.m.

Social media: Student Finance England writes about popular events on Twitter, Facebook, and other popular social networking sites. They will answer as soon as possible if you send them a direct message or a tweet with your question.

For online help, the Student Finance England website has live chat support where you can talk to a representative right away. From Monday to Friday, 9 a.m. to 5:30 p.m., you can use the online service.

If your question is more complicated, you may need to send paperwork or letters through the mail. The official Student Finance England page has an address where you can do this. One more option is to talk to Student Finance England immediately. You can also go to the Citizens Advice Bureau or the National Union of Students (NUS), which works with them.